HOW CAPITALISM WILL SAVE US

I read this article by Steve Forbes at pg.18 of Forbes Asia November 10, 2008 issue and I thought I will share the four charts to you all. The full article is also online at Forbes.com.

Higher Oil Prices Weren't Caused By Supply & Demand

Steve Forbes 10.22.08, 6:00 PM ET

Forbes Magazine dated November 10, 2008

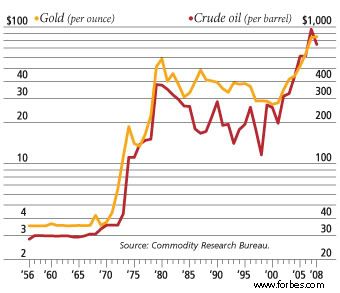

For decades the prices of gold and oil have closely paralleled one another. In 2003 an ounce of gold would have bought you 12 barrels of oil. Today that ounce will buy you about 11 barrels, even though the nominal price of oil is almost three times what it was in 2003. Thus most of the oil increase is a result of dollar inflation, not traditional supply and demand.

The Importance of a Strong Dollar

Steve Forbes 10.22.08, 6:00 PM ET

Forbes Magazine dated November 10, 2008

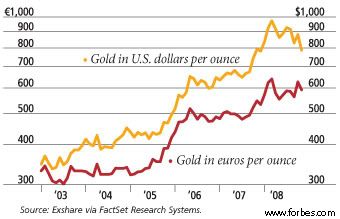

Since 2002, the value of the dollar against the euro has trended down sharply. We've only recently seen a correction. For the economy to fundamentally improve, this trend must continue.

The Cost of Inflation

Steve Forbes 10.22.08, 6:00 PM ET

Forbes Magazine dated November 10, 2008

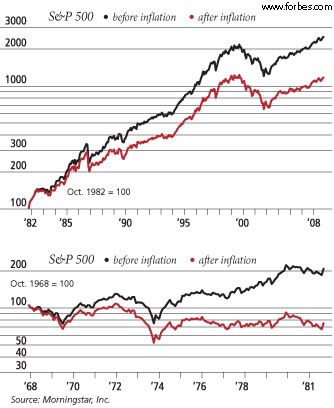

There's no better measure of inflation's impact than looking at the spread of the S&P over time, both before and after inflation adjustment.

Good As Gold?

Steve Forbes 10.22.08, 6:00 PM ET

Forbes Magazine dated November 10, 2008

The Fed should tie the dollar to a gold price range of $500-$550. That's one way to fend off future monetary blunders.

0 Comments:

Post a Comment

<< Home